2026 Federal Tax Updates Announced

When the One Big Beautiful Bill (OBBB) Act was passed on July 4, the legislation left several unanswered questions that the IRS is now addressing.

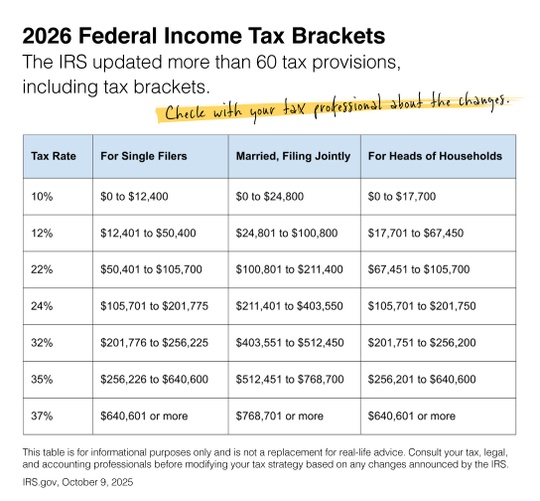

The IRS undergoes this process every year, but this time around, the OBBB has added to the uncertainty. The Internal Revenue Service reviews more than 60 tax provisions for inflation to prevent what is known as “bracket creep.”

The IRS announced new federal income tax brackets and standard deductions for 2026 in early October. The agency adjusted several numbers, which apply to tax year 2026 for returns filed in 2027.

Other Highlights

The standard deduction will also increase in 2026, rising to $32,200 for married couples filing jointly, up from $31,500 in 2025. Starting in 2026, single filers can claim $16,100, a bump up from $15,750.

The AMT exemption amount for 2026 is $90,100 for singles and $140,200 for married couples filing jointly.

The IRS also provided updates for the Earned Income Tax Credit, the Child Tax Credit, capital gains tax rates and brackets, and qualified business income deductions.

Please let us know if you have any questions about the IRS updates or any other tax law changes. We'd be happy to pass along any information that we might have.

CNBC.com, October 9, 2025

IRS.gov, October 9, 2025